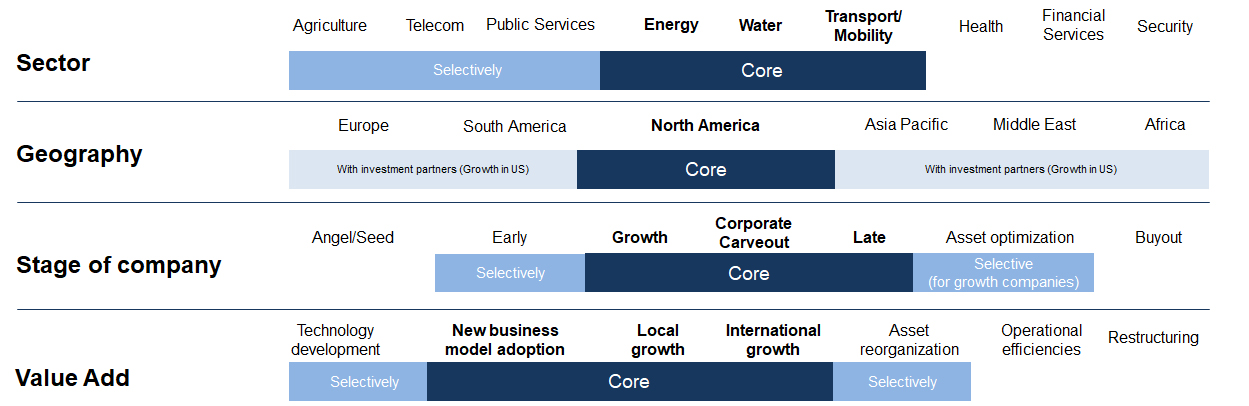

Alongside partners, we invest in companies that serve selected infrastructure sectors with introducing technology to create a value-added and competitively advantage position. It is a late stage venture/growth investment focus, which means we look for established business that are at the next step of growth.

Standalone cases as well as technology carve-outs are focus area of us. Large companies may often have interesting capabilities but not the right setup to fully capitalize internally on the equity value of the opportunity. In a highly dynamic environment, this can ultimately lead to a increasingly fast death of those capabilities. Carving those out can increase the probability and success and unlock additional growth opportunities.